Credit Card Surcharging & Dual Pricing—Protect Your Bottom Line

Maximize your earnings with Dodson’s Dual Pricing, now with straightforward credit card surcharging! Credit card fees can silently subtract up to 3.5% of your sales, but our Dual Pricing approach can change that. It provides two distinct pricing options: a lower price for cash payments and a slightly higher one for credit card payments, including credit card surcharging to cover processing fees. This method is simple and transparent, allowing you to save significantly while clearly communicating payment options to your customers. Embrace Dodson’s user-friendly system and join the community of businesses enjoying increased savings and improved profits with transparent, fair pricing.

How Dual Pricing and Surcharging Can Benefit You

Keep your Profits and Offer Freedom of Choice

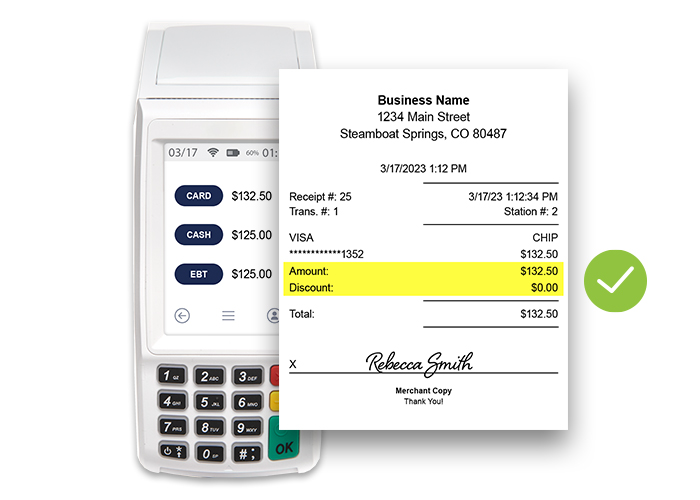

How Dual Pricing Works

Save on fees with cash payments, small added charge for cards.

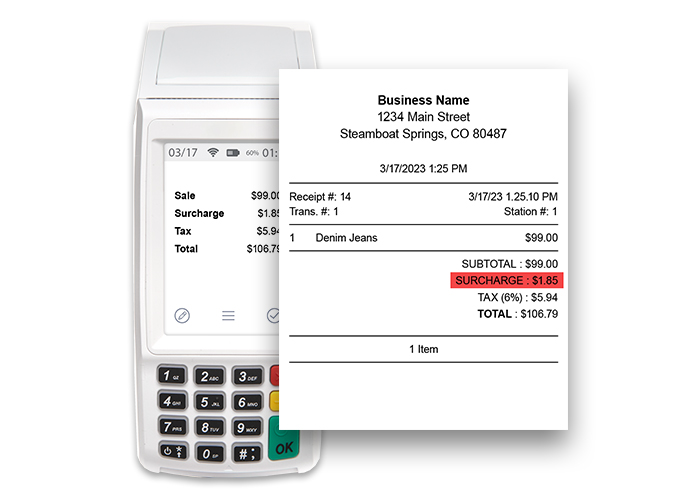

How Surcharging Works

Transparent extra fee on card transactions to cover processing costs.

Unlock the Benefits of Credit Card Surcharging

Cash Discounting Can be a Financial Game-Changer

Save Thousands

Dual pricing can significantly improve your bottom line

Competitive Edge

Stand out from businesses who don’t offer cash discounting

Next-Day Deposit

Receive your sales and surcharge revenues the next day

Effortless Payments

Experience hassle-free and reliable payment processing services

Stay In Compliance

The program complies with all state and federal regulations

Streamlined Process

Our POS systems make it easy to apply and exclude fees

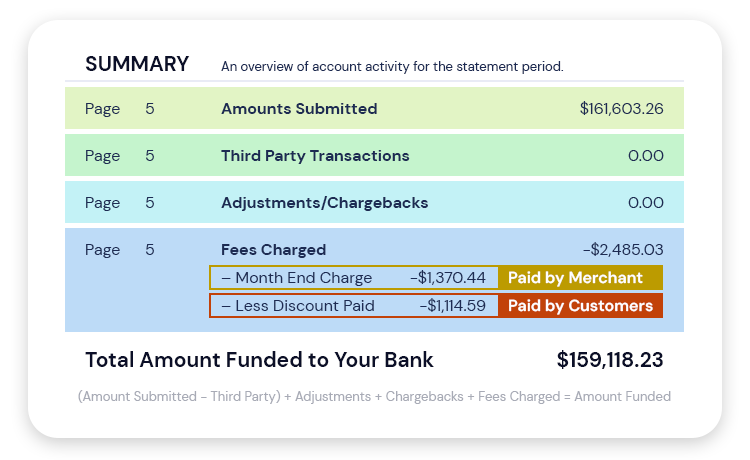

How Much Can Credit Card Surcharging Save You?

See Real World Savings in Black and White: Your Bottom Line Will Thank You.

Turn the Tables on Transaction Fees Today

Are you fed up with transaction fees continually eating into your revenue? Dodson Payment Solutions empowers you to transform those pesky fees into newfound opportunities. With our Credit Card Surcharging and Dual Pricing Solutions, you can recover the cost of credit card transactions and provide a choice that rewards cash payments. Your journey towards better profit retention starts here. Take action now, and stop letting your hard-earned money slip away with each swipe. Learn more about how you can safeguard your bottom line and offer more payment flexibility to your customers today